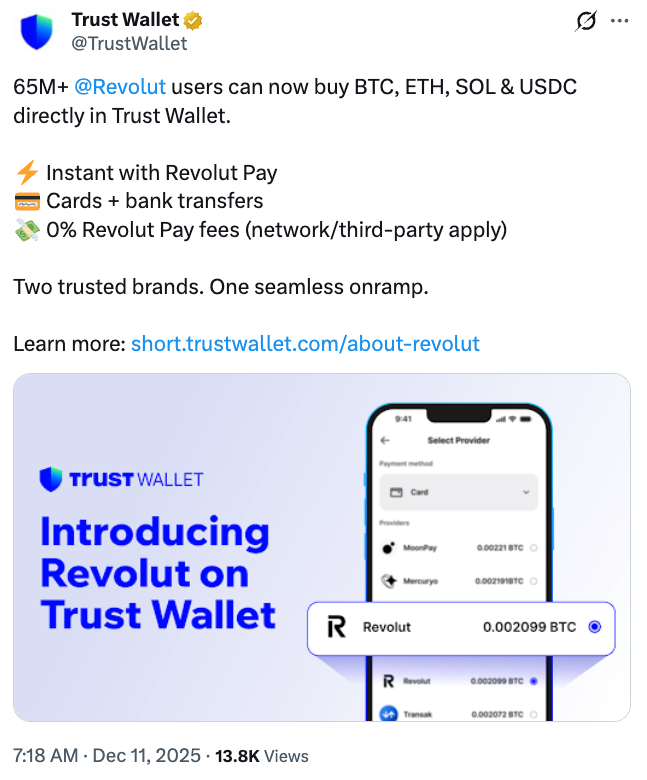

Trust Wallet, the self-custodial crypto wallet owned by Binance co-founder Changpeng “CZ” Zhao, has partnered with European fintech unicorn and digital banking giant Revolut to introduce a new way to purchase crypto assets on its platform.

Trust Wallet users can now buy Bitcoin (BTC), Ether (ETH) and Solana (SOL) with Revolut through a direct integration, the company announced on Thursday.

With a minimum purchase starting at 10 euros ($12) and capped at 23,000 euros ($26,950) daily and per transaction, Trust Wallet’s new buy option is expected to provide a faster and easier way to access crypto from Europe.

In October, Revolut scored regulatory approval from the Cyprus Securities and Exchange Commission to offer crypto services across 30 European Economic Area markets in compliance with the European Union’s Markets in Crypto-Assets Regulation (MiCA) framework.

Stablecoins like USDC not supported, for now

The integration will initially support only three crypto assets, but the companies said they expect to add stablecoins such as Circle’s USDC (USDC) at a later stage.

The feature enables zero-fee crypto purchases using multiple fiat currencies supported by Revolut, including the euro, the British pound, as well as the Czech koruna, Danish Krone, Polish Złoty and others.

While Revolut–Trust Wallet crypto purchases are offered with zero fees, adding money to a Revolut account is not free of charge in many cases, including via bank transfers, card top-ups and cash deposits. Cash deposits are subject to a 1.5% fee and are limited to $3,000 per calendar month, according to Revolut’s FAQs.

Related: Crypto self-custody is a fundamental right, says SEC’s Hester Peirce

The integration came shortly after Revolut secured a $75 billion company valuation after completing a private share sale in late November. “This makes us Europe’s most valuable private company and in the top 10 of the world’s most valuable private companies,” Revolut said in a post on X.

CZ-backed Trust Wallet has been actively tapping into trending market sectors, including prediction markets and real-world asset tokenization, expanding access to these offerings for self-custody users.

Cointelegraph contacted Revolut and Trust Wallet for comment on the integration, but had not received a response by publication.